Managing personal finances often feels chaotic, leading many to shy away from budgeting altogether. But expense tracking apps provide easy tools to gain control and confidence in money management. By automatically organizing spending data across your financial accounts, the best expense tracker apps surface insights, simplify planning, enable better decisions, and foster good money habits over time. In this blog, we have covered the 11 best expense tracker apps for individuals and small businesses.

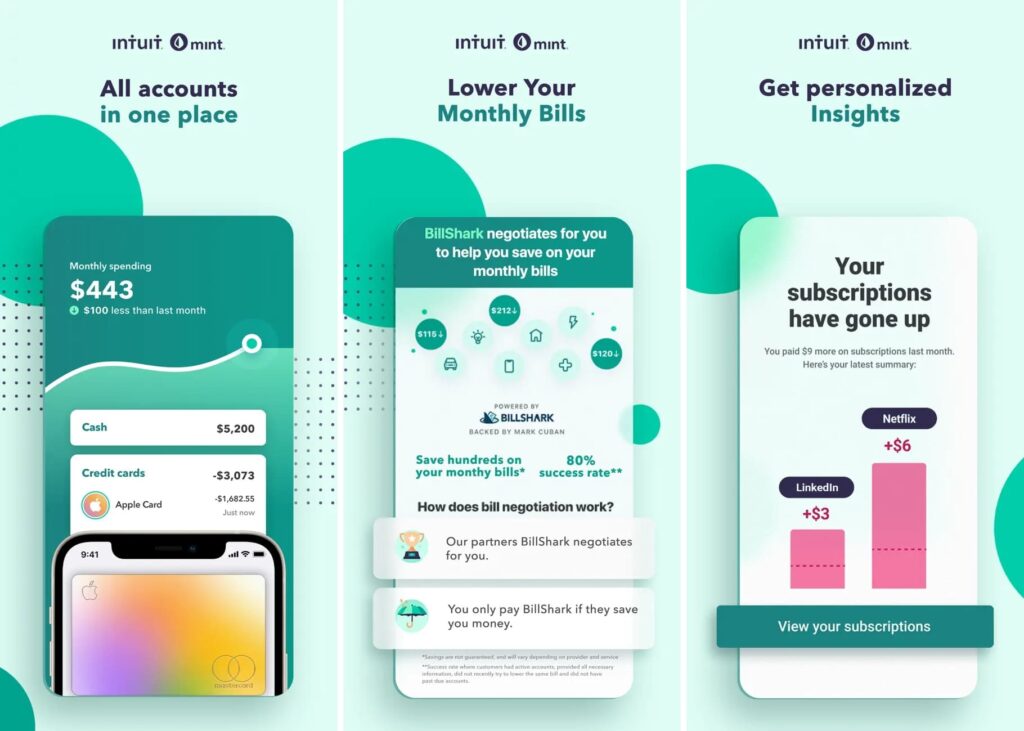

1. Mint: Budget & Expense Manager

Mint is one of the most popular and full-featured money tracking apps, bringing together all your financial accounts into one convenient dashboard. By connecting your checking, savings, credit cards, investments, loans, and even property accounts, Mint provides a comprehensive look at your net worth and cash flow.

As one of the first finance apps on the market, Mint has robust security protections and advanced features for managing debt, investments, retirement planning, and taxes. With its focus on complete financial transparency and money management, Mint is ideal for those wanting to maximize insights and control over their expenses in one place.

- Payment reminders on time

- Connects all financial accounts easily

- Budgeting and bill pay features

- Spending trends and subscription monitoring

- Free credit score

- Calculator for loan repayments

- More limited for tracking day-to-day purchases

- A regular ad schedule

- Occasionally, there are glitches

Price: Free

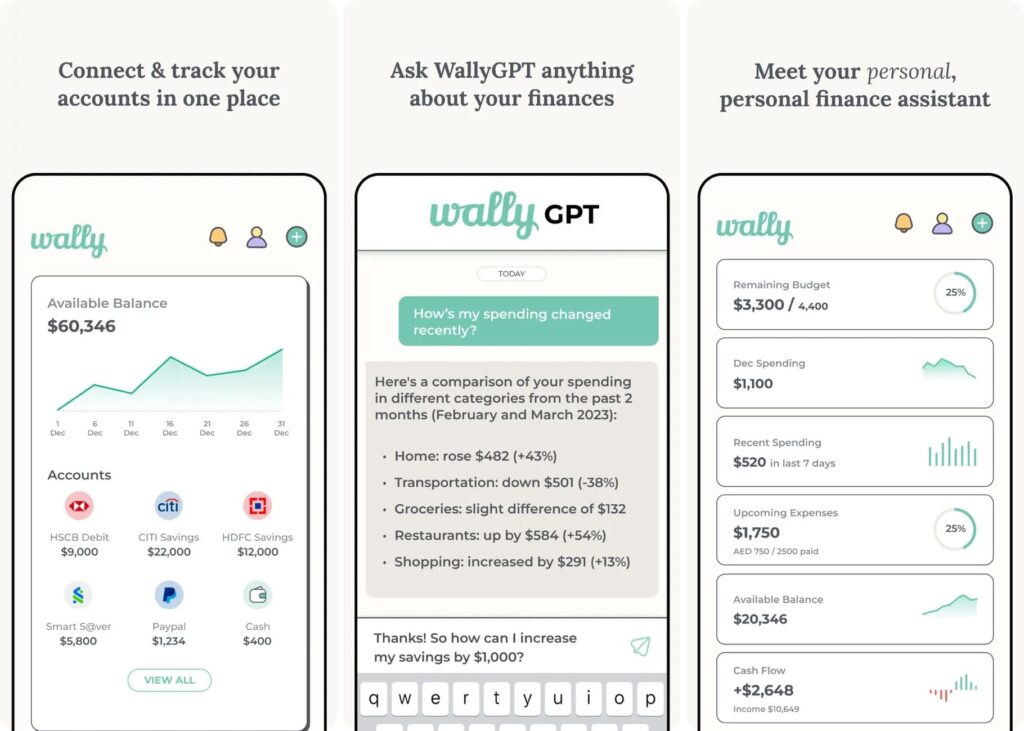

2. Wally: Personal Expense Tracker App

Wally aims to be your personal financial advisor in your pocket. While providing expense/budget tracking basics across devices, Wally’s key differentiator is WallyGPT, an AI assistant that can have personalized conversations about your expenses. WallyGPT reviews transactions and provides contextual insights and thoughts on your spending habits and budgets.

Besides the conversational AI assistant, Wally offers secure, automated bank connectivity and cash flow analysis. If you’re seeking more than just basic expense organization and want customized advice on managing your money, Wally’s experimental AI assistant aims to provide just that. As it’s still in beta testing, the app is best for early tech adopters willing to deal with a few rough edges. But Wally has an innovative and ambitious vision that shows promise.

- Clutter-free dashboard

- AI assistant for analysis

- Easy and secure syncing

- Contextual insights on spending

- Interactive pies, bars, and line charts

- Less focus on bill tracking

- AI features in beta

Price: Free ( Offers In-App Purchases )

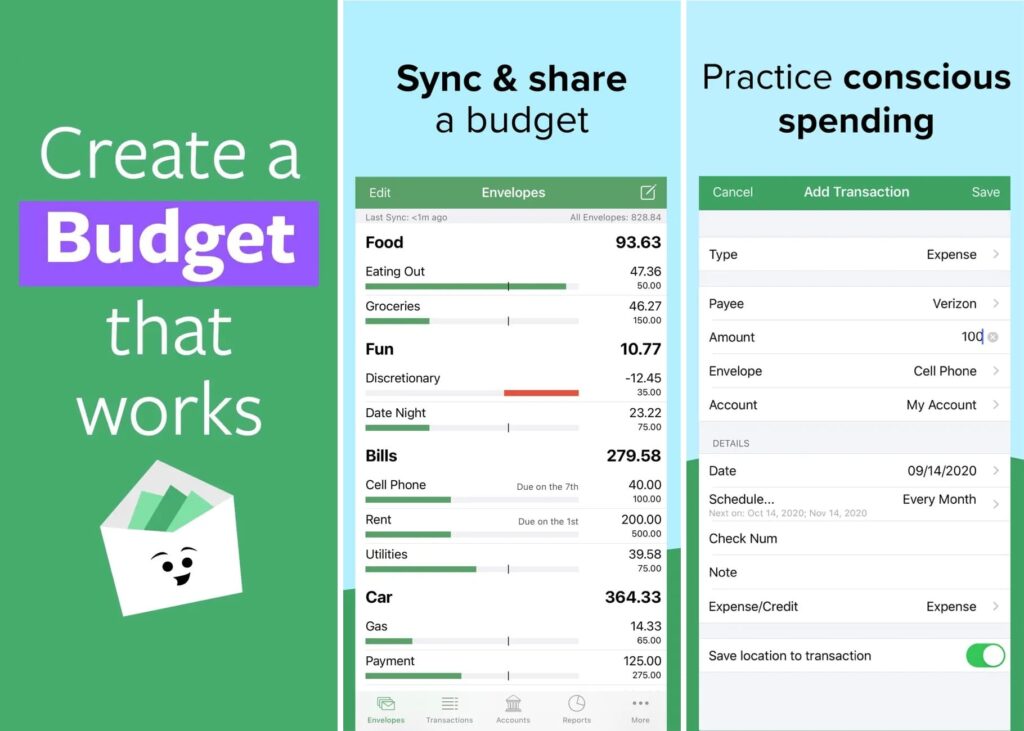

3. Goodbudget Budget Planner – Money & Expense Tracker

For those who prefer using the tried-and-true envelope budgeting system to manage finances, GoodBudget brings that method into the mobile age. The “digital envelope” system allows you to allocate planned spending money into different categories, with balances decrementing as you log expenses. GoodBudget stands out with its focus sharing budgets across devices, advanced reporting engine, and emphasis on planning.

The app provides a wide variety of graphical reports on spending vs budget that promote better money insights. And features like scheduled transactions and reminders help optimize planning. With its clean interface and focus on collaborative responsibility over finances, GoodBudget is a great budget tracking app for couples or families looking to replace their physical envelope budgeting system with an easy-to-use digital alternative.

- Regular and Annual Envelope budgeting system

- Regular and Annual Envelope budgeting system

- Charts and graphs

- Sync up to 5 devices

- Personal and friendly email support

- Transactions CSV download from website

- Limited automation

- Can enhance customization

Price: Free ( Offers In-App Purchases )

4. Spendee Money & Budget Planner

Spendee aims to be your personalized finance advisor by connecting spending data to spark better money habits. By syncing with your bank accounts and providing intuitive infographics on spending. Key features providing awareness into your finances include automated transaction feed, spending distribution charts, budget monitoring alerts, cash flow forecasts, and personalized financial advice.

Spendee even allows you to store digital versions of receipts, warranties, gift cards and more for better tracking. With its clever visualizations and money recommendations, Spendee excels at highlighting areas for saving and optimizing your spending habits. Those seeking to better understand their cash flow, cut unused subscriptions, reduce impulse purchases, or bolster savings rates can benefit from Spendee’s active guidance.

- Automated transaction syncing

- Budgeting capabilities

- Award winning design

- Secure Data Sync

- Manage your personal finances

- No bill management features

- Free version limited

Price: Free ( Offers In-App Purchases )

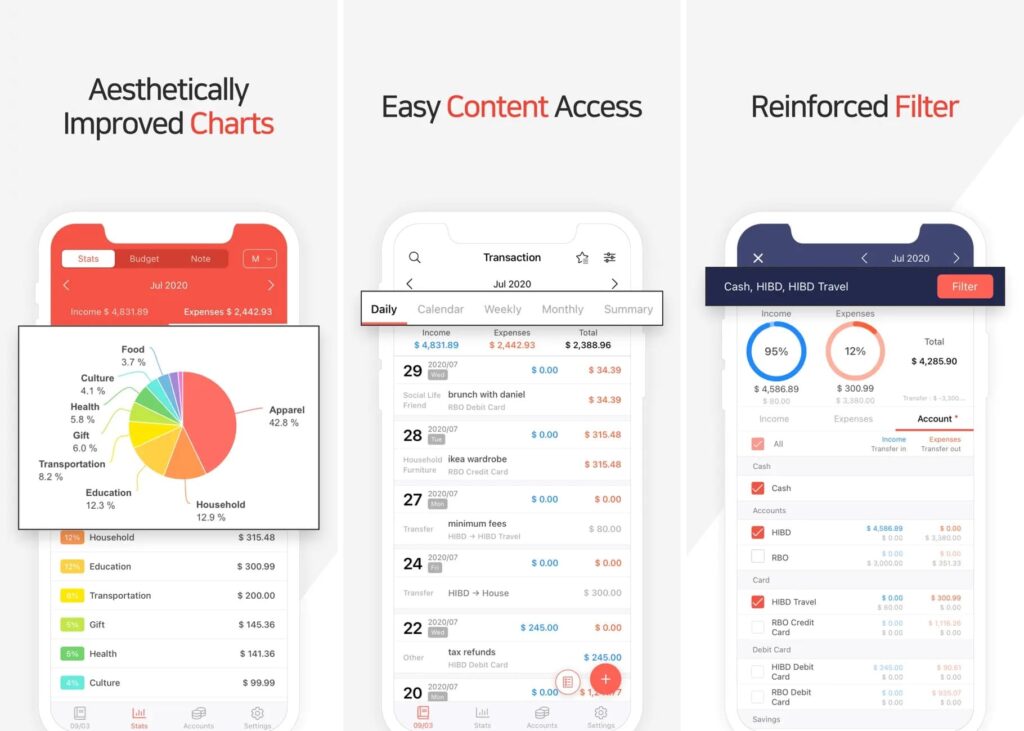

5. Money Manager Expense & Budget

Money Manager Expense & Budget lives up to its name with a robust set of accounting, analysis, planning, and tracking capabilities tailored for personal expenses. It utilizes principles of double-entry bookkeeping to provide a flexible, extensible system for money management. You can customize categories, sub-categories, payment types, currencies, and more to track income, expenses, budget goals, debts, investments, and net worth your way.

This money tracking app provides a wide variety of detailed reports on cash flow, future projections, debts, spending distribution, accounting reconciliations, and integrated calendars. While the sheer depth of options makes Money Manager more complex than simple spending apps, its professional-grade power is ideal for those seeking advanced control over their finances.

- Custom categories and configuration

- Robust reporting ( Weekly, Monthly, Annual)

- Clearer understanding with visuals

- Support for multiple currencies

- Card management function

- Ability to set up separate accounts for expenses

- backup and restore your data

- Manual data entry

- Limited features

- Ads in Free Version

- Budget management is not supported

Price: Free ( Offers In-App Purchases )

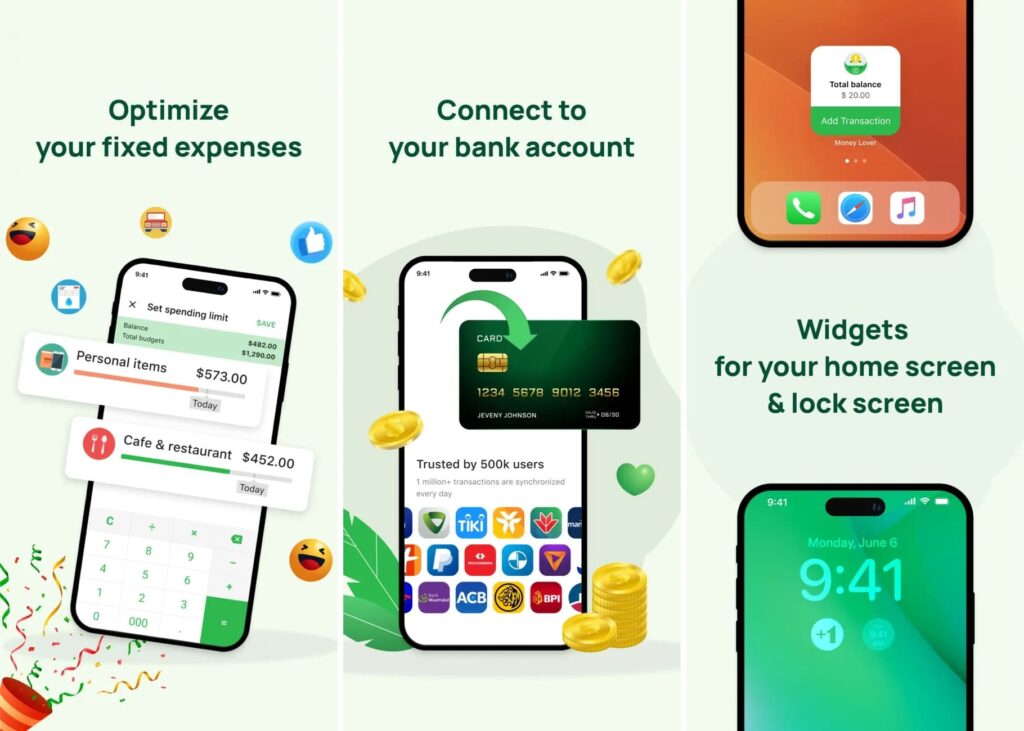

6. Money Lover: Expense Manager

As its name suggests, Money Lover aims to make managing personal expenses more joyful and effective. With its friendly interface, automated financial overviews, customized budgets, bill reminders, and debt management tools, Money Lover simplifies money matters. After connecting your financial accounts, Money Lover provides graphical reports on income, spending distributions, net worth over time, and budgets.

This expense manager app uses past transactions to forecast future spending, dynamically recommend budgets, and provide tips optimized to your habits. Overall, Money Lover reduces the mental burden around tracking expenses, balancing budgets, avoiding fees, and optimizing spending with tailored money advice and automation.

- User-friendly interface

- Spending tracking that’s hassle-free

- Can export transaction lists to Excel.

- Debt tracking and Built-in calculator

- Bank-level security

- Support With Apple Watch

- Limited automation

- No travel features

Price: Free ( Offers In-App Purchases )

7. Monefy: Money Tracker

Monefy lives up to its name as a simplified money tracking app. Speed and minimalism are the names of the game here. Monefy’s slick interface allows you to quickly add transactions manually with just the amount and date. The app automatically graphs expenditure distributions across consumer-defined budgets and categories with little setup.

With its lightweight and user-friendly approach, Monefy excels at fast expense tracking for things like business trips, temporary projects, or vacations where receipts pile up. Those looking for a frictionless way to stay on budget by quickly capturing transactions while on the go will find Monefy useful.

- Efficient Calculator

- Track Income & Expenses

- Multi-currency support

- Google Drive and Dropbox support

- Get Reports in detail

- No invoice features

- Light on analysis

Price: Free ( Offers In-App Purchases )

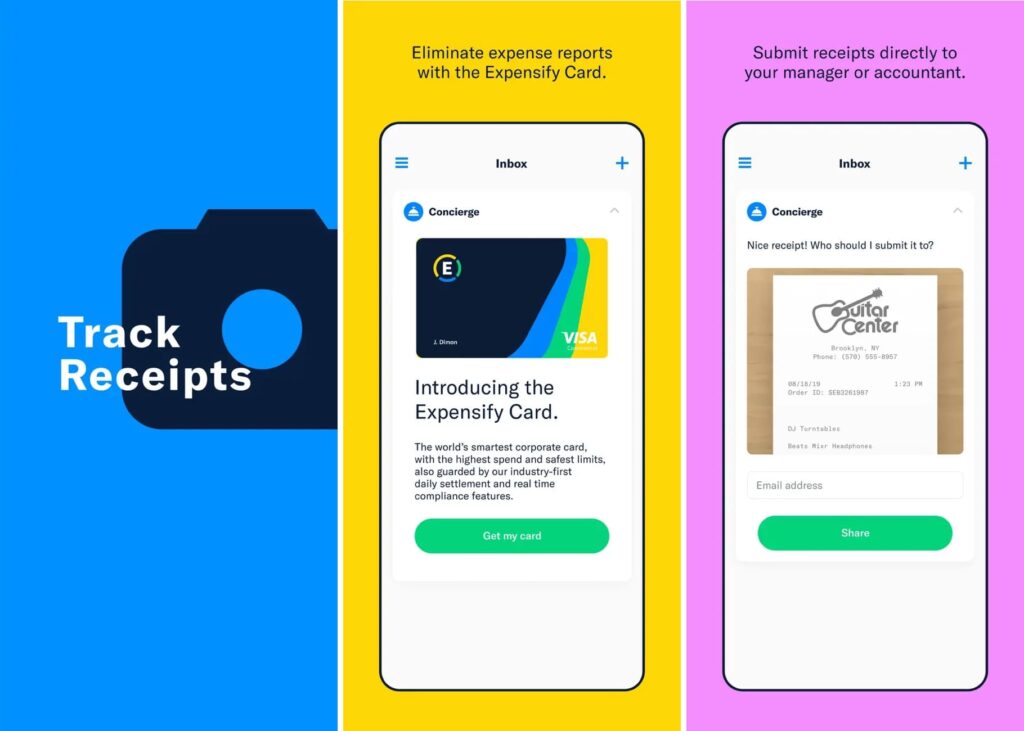

8. Expensify – Expense Tracker

Expensify sets the standard for automated receipt tracking with advanced OCR scanning, expense reporting, approvals, integration, and partner perks. Ideal for frequent travelers and spenders dealing with lots of expenses, Expensify automates data entry by scanning and extracting key details from receipts and linking credit card feeds.

For convenience, Expensify even works directly with companies like Uber, hotels.com, Southwest and others for automatic data feeds and member discounts. The premium features and business orientation make Expensify less suitable for individual consumer budgets. But for frequent work travelers or business owners, Expensify is a game changer for centrally tracking costs and seamlessly integrating reporting across tools. An Expense Tracker App for Business Travelers

- Multi-currency support

- Expense categorization

- Automated receipt scanning

- Advanced tax reporting

- Track and Manage Expenses

- Travel expense management

- Expensive paid plan

- Steep learning curve

Price: Free ( Offers In-App Purchases )

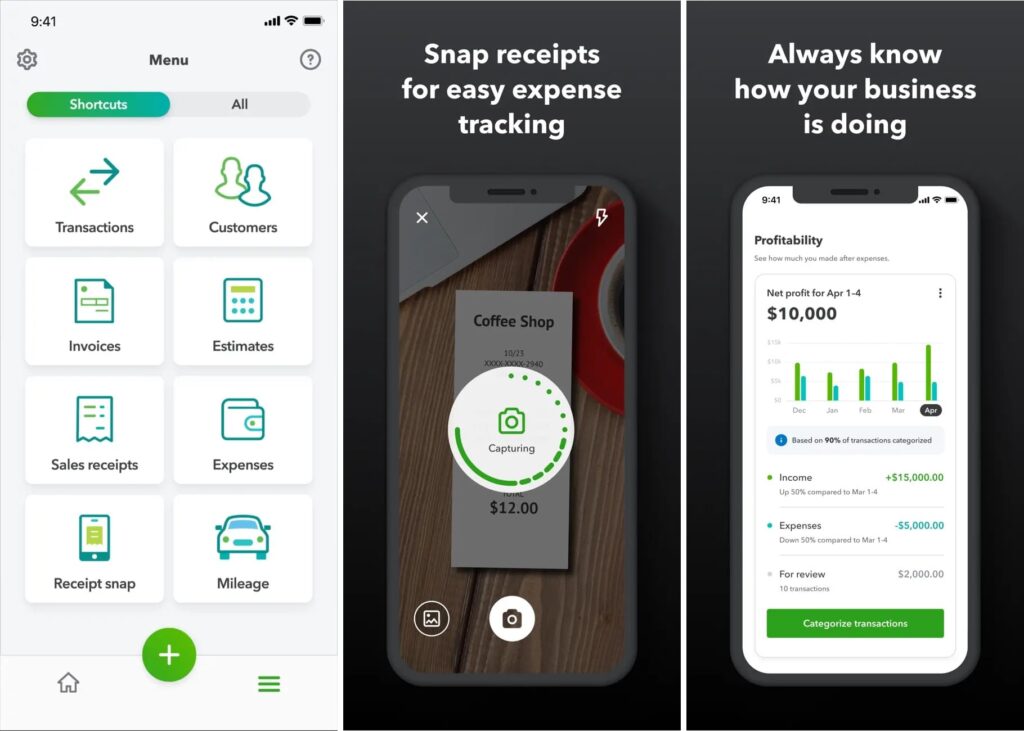

9. QuickBooks Accounting – Invoices, Expenses, & Mileage

QuickBooks Accounting brings leading small business financial software into a robust mobile app tailored for tracking income, expenses, mileage, invoices, cash flow, accounting, and taxes. Deep integration with QuickBooks Online unlocks powerful reporting and analysis features for your books. Key features include automated mileage tracking with GPS, customizable invoices and sales receipts, dashboard business insights on profit & loss, category spending breakdowns, account reconciliations, customer and vendor management, receipt capture, tax deductions, invoicing, and more.

The QuickBooks Accounting mobile app provides seamless synchronization for accountants, small business owners, and solopreneurs to manage their finances from anywhere. With exceptional business accounting capabilities fully integrated with an industry leader, it’s a must have for QuickBooks power users. But consumer audiences may find the app overkill for their needs.

- User-friendly and Simple

- Real-time reporting

- QuickBooks integration

- Suitable for large corporations

- Receipt scanning feature built-in

- Issues with integration

- Requires QuickBooks subscription

- Slightly Slow responsiveness

Price: Free ( Offers In-App Purchases )

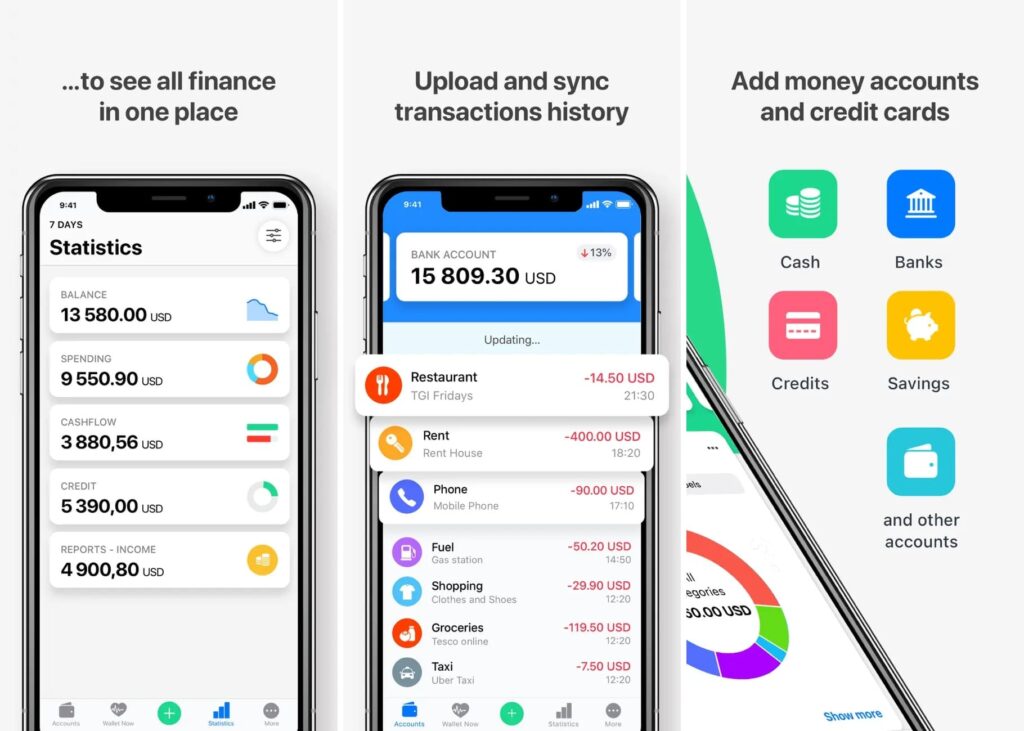

10. Wallet – Daily Budget & Profit

Wallet provides user-friendly money management via flexible budgets, automated transaction tracking, debt management tools, and easy-to-digest financial charts tailored to ordinary consumers. This App aims to help you gain financial confidence through better planning and accountability. Wallet stands out with its visually engaging, interactive reports on net worth, spending, budget vs actuals, debts, and more.

The fully redesigned cash flow analyzer provides insights into income, expenses, and transfer trends over custom durations. Overall, Wallet lowers barriers to sound personal finance practices. Those seeking to get out of debt, save more aggressively, or build towards financial goals will appreciate Wallet’s elegant interface and focus on encouraging better habits through awareness.

- Personal Expense Tracker

- Multiple currencies support

- Elegant, clean, and beautiful

- Flexible, recurring budgets

- Advanced record tracking

- Limited reporting features

- Issues with syncing

Price: Free ( Offers In-App Purchases )

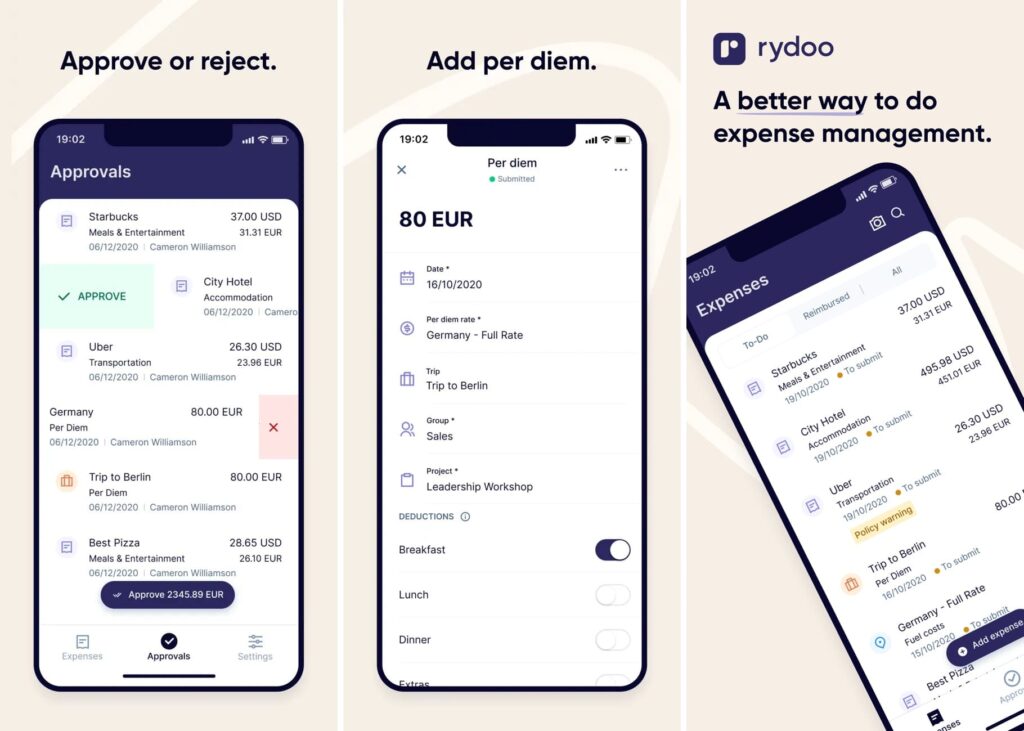

11. Rydoo – Business Expense Management

Rydoo targets businesses with a travel and expense management app squarely focused on simplifying and controlling costs. Features cater extensively to frequent business travelers, approvers, and finance teams. From built-in travel booking to automated expense reports to custom approval flows, everything zeroes in on efficiency.

While functional for individuals, Rydoo really shines for streamlining enterprise business spending from end-to-end. Large organizations can tailor Rydoo to model their processes and hierarchy for managing T&E. But the focus on complicated organizational needs makes this money tracking app overkill for consumers looking simply to track personal expenses.

- Strong travel features

- Custom approval workflows

- Receipt OCR

- Smooth handling of multiple currencies

- Easy reporting of expenses

- Not best for personal use

- Software lags occasionally

- Steep learning curve

Price: Free

Conclusion

Personal finance apps run the gamut from simple manual trackers to AI-powered advisors to full-service accounting platforms. Determining the best choice depends on your needs and financial literacy level. While apps reduce effort, achieving money goals requires building smart lifelong habits. Expense trackers serve as the launch pad. So embrace the digital tools now to secure financial freedom for your future.

In case you missed!