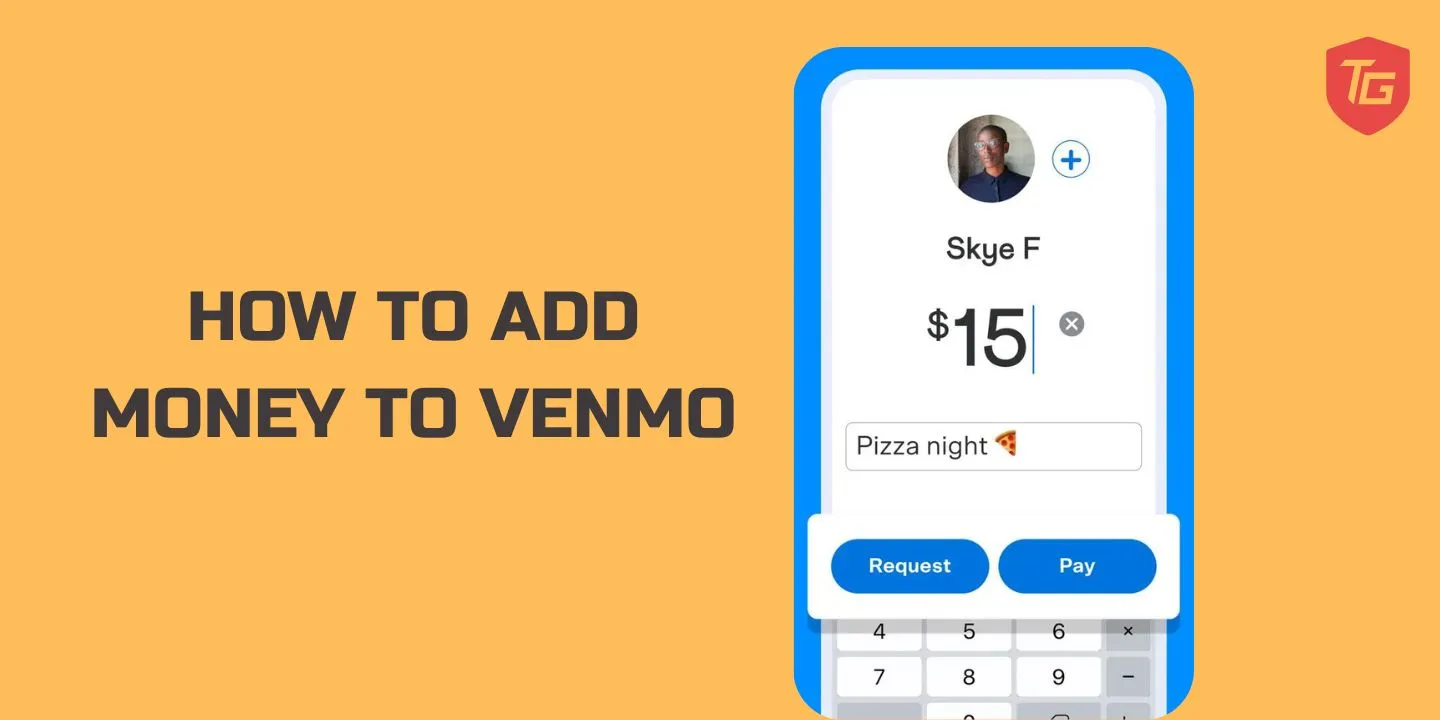

Do you need a quick top-up for your pending bill payments? Or do you want to send some dollars to your friend? Venmo takes care of all your digital transactions. But hey, to send some bucks to your friend, you will first need to have some in your own account. You must be wondering now, “How to add Money to Venmo?” Well, if that is the case, you have come to the right place. Let us now dive deep into knowing more about adding money to Venmo. But first, let us learn more about Venmo.

What is Venmo?

Using a smartphone app, users can send and receive money with PayPal’s mobile payment service, Venmo. Additionally, it makes it possible for retailers to get paid by customers who use the service.

Essentially, Venmo offers a convenient and social method of paying peers for loans you have made without requiring you to handle cash. Adding funds to your account balance using the Venmo app is a simple way to send payments or make purchases using your Venmo card.

How to Add Money To Venmo?

There are a number of ways you can add money to Venmo.

1. Using your Bank Account

Step 1: Launch the “Venmo” App. Hit the “Me” tab.

Step 2: Click on “Manage Balance.”

Step 3: Tap on “Add Money.”

Step 4: Enter an amount that you desire to add.

Step 5: Tap on “From Bank Account.”

Step 6: Select the desirable bank account.

Step 7: Click “Add Money.”

2. Using a Credit or Debit Card

Step 1: After opening the Venmo app, Select the “Me” tab.

Step 2: Click on “Manage Balance.“

Step 3: Press the “Add Money” button.

Step 4: Enter the desired amount.

Step 5: Choose “From bank or debit card.”

Step 6: After entering your card details, select “Add Money.”

How Much Is The Venmo Transfer Limit?

Venmo imposes specific strict measures on the money transfer limit. We have broken down the transfer limit one by one. Let’s have a deeper look at it.

Daily Limit

The daily limit can be increased, but it primarily depends on the account’s verification. Your daily transactions are limited to $300 if your profile is unverified; however, once verified, your daily Venmo maximum transfer limit rises to $5,000.

Weekly Limit

This works the same as the one mentioned above. The weekly sum of monies transmitted for customers who still need to finish the verification process is $500; following verification, it rises to $5,000.

Monthly Limit

This cap governs monthly transactions. Verified clients can send and receive up to $20,000 every month, while unverified clients can only trade $1,000. However, every procedure is still limited to $5,000.

FAQs

Connect a bank account to your Venmo account and initiate a transfer to add funds to your account. As an alternative, you might ask someone to put some money into your Venmo account.

Standard financial transactions and private user-to-user transfers can be made using Venmo’s free basic capabilities. However, there are some activities that have a price associated with them. For instance, there is an additonal 3% charge for credit card transactions, and there is a 1% fee for quick or instant transfers.

Conclusion

There you have it, then! You only need to tap a few times on the Venmo app to load and use your account. Venmo makes handling money problems simple, whether you’re paying back a loan, sharing a bill with friends, or sending a last-minute gift. So, now its time to do away with the cash and make Venmo your go-to payment assistant.

In case you missed!